Five great tips for your insurance agent resume

Insurance is a highly competitive industry, and the best jobs are highly sought after. Ensure your insurance agent resume jumps to the top of the shortlist with these great tips.

If you're looking for a new role as an insurance agent, it's vital to have your interpersonal skills in order. Then, it's all about crafting a resume that proves to employers you not only understand the insurance industry like the back of your hand, but you have the drive and determination to help clients find the best policies for their needs.

Furthermore, while you want to do what's best for customers and clients, it's imperative to remember that your job, first and foremost, will often be to sell.

There's no better way to verify with a recruiter that you're capable of selling before they even meet you than to prove you can sell yourself.

Beyond the standard resume guidelines, a great insurance agent resume will consider the following factors.

1. Get your insurance agent resume format right

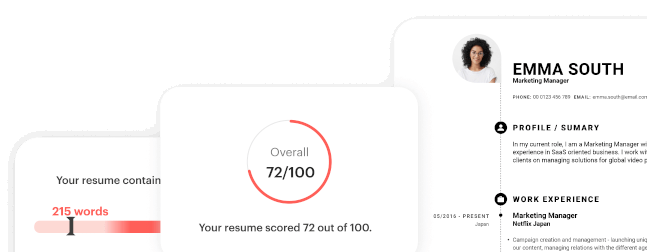

Recruiters have a lot of resumes to go through. The chances are you've applied to a job because something specific about it appeals to you, and that's like to be the case for all the people also competing for the job. With so much competition, the seven seconds you typically have to make an impression might be cut even further, so it's vital to get the format right and catch the eye immediately.

Visuals are often overlooked, and some of your competition will feel that it's the content that matters, not the aesthetics. However, when they've got lots to get through, why would a recruiter devote time to a resume that looks boring?

Take the time to create a dedicated header, and generally stick to the professional resume format. Also, go with professional fonts like Calibri, and avoid older, more conventional ones like Times New Roman and Arial.

Put your name and title in the header and make your contact information clear – after all, there's no point winning the job if nobody can tell you about it!

Choose your preferred template and make your resume shine.

2. Open with an appealing summary or resume objective

Some employers will go straight to the experience. However, many appreciate the chance to read a slimmed-down version of the resume before deciding whether to read on. So naturally, it's crucial to grab their attention here – think of it as the blurb on the back of a book. Your summary won't necessarily win you the job, but it's the gateway to capturing attention.

Insurance agent professional summary example

Certified Insurance Agent possessing exceptional communication skills and the crucial ability to think critically and solve complex problems. With 4 years of relevant experience paired with a bachelor's degree in Business & Management from the University of Surrey, Susanna is looking for an Insurance Sales Agent job within a forward-moving company.

3. Tailor your work experience section to a specific role

Too many candidates believe that only the cover letter needs to change between applications. However, if you intend to secure an interview, you need to tailor your resume to the role. Try to go out of your way to prove you've read and understood the insurance agent job description by addressing specific points.

Include your most recent insurance agent experience and pick out parts of the role related to numbers. For example, if you sold twice as many policies as anyone else on the team, make sure you mention it! Be as specific as possible without losing sight of the job at hand.

Insurance agent work experience section example

BNM Group, Inc., London, United Kingdom

Insurance Sales Agent

2014-2017

- Provided professional insurance advice to clients, ensuring that everything was in compliance with their needs and goals.

- Analyzed market trends, assisted in the account management, and worked on the development and implementation of new sales strategies.

- Conducted annual reviews, produced required forms and documents, and pro-actively participated in the creation of new insurance products.

- Completed contracts, resolved any customer inquiries, and constantly monitored and evaluated the sales performance.

- Won the Employee of the Year Award once for meeting and exceeding all assigned sales targets.

4. Your education still matters

You might not need a specific qualification to become an insurance agent. Still, your educational achievements demonstrate a well-rounded employee with a personality beyond their sales and customer service skills.

Wherever possible, associate education achievements with skills that matter in the insurance agent role. Even if you've never done the job before, you'll appreciate that being great at it involves:

- Working as part of a team

- Communicating clearly both internally and externally

- Showing a willingness to solve problems and find solutions

- The ability to understand potentially complex policies and terminology

If you don't have extensive experience to verify these skills, your educational accomplishments can quickly come into their own. For example, being part of a winning sports team, serving in the debate society, or enacting change at your educational institution can all serve as transferrable skills that will encourage employers to sit up and take notice.

Listing education in your insurance agent resume

University of Surrey, Guildford, United Kingdom

Business & Management

2012-2016

- First Class Honours (Top 10% of the Programme)

- Clubs and Societies: FinTech Society, Marketing Society, Tennis Club

5. The best skills to put on your insurance agent resume

Insurance agent roles can span everything from entry-level positions to senior management. Once again, it's all about tailoring your resume to the job at hand. Affirm through your resume that you have both the hard and soft skills required to succeed in the role.

Remember, you don't have infinite space. Your resume will almost always perform better when it takes up a single sheet than if it goes on for multiple pages. Some recruiters even consider multi-page resumes as demonstrating a lack of respect for their time!

In essence, don't list everything you're capable of. Instead, focus on the skills you'll bring to the role that will enable you to succeed and work to the company's benefit.

Depending on the role, the most important hard skills might include

- Sales experience

- Upselling and cross-selling products

- Cold calling

- Reporting

- Use of CRM software

- Existing product knowledge

Even this shortlist can demonstrate the importance of tailoring. For example, your new role might involve only following up with warm leads and existing customers. In that case, there's no need to take up valuable space on your resume with cold calling.

Similarly, you might have no knowledge of a company's insurance products beyond what they list on their website. There's no point championing your product knowledge if you don't yet have enough to make a difference – although you can always refer to your abilities as a fast learner!

Soft skills matter too in insurance. If you've got experience, you'll already know what you're good at and will be capable of judging how much those skills matter in a new role.

Effective soft skills for your insurance agent CV

- Teamworking and collaboration

- Clear communication – a must in sales

- Problem-solving abilities

- Time management and being a self-starter

- Excellent listening skills

You can focus on what you're good at, decide which skills are most appropriate for the role, or, ideally, include a mix of both on your insurance agent resume.

With these five ideas in hand, you'll be able to put together a resume that stands out even in the highly competitive world of insurance, ensuring your skills, experience, and education receive the attention from hiring managers they deserve.

Prospettive di carriera nella contabilità e nella finanza nel 2025

Si prevede che tra il 2023 e il 2033 i posti di lavoro nella contabilità cresceranno del 6% e quelli nella finanza del 9%. Si tratta di una crescita molto più rapida rispetto alla media nazionale per tutte le professioni. (Fonte: U.S. Bureau of Labor Statistics).

Ogni anno si prevede l'apertura di circa 130.800 posti di lavoro nel settore contabile e di 30.700 posti di lavoro nel settore finanziario, principalmente a causa della crescita del settore e della sostituzione dei lavoratori che vanno in pensione o che lasciano il lavoro.

Stipendi base medi negli Stati Uniti per i ruoli più richiesti nel campo della contabilità e della finanza:

- Contabile: $65.286/anno

- Revisore contabile: $65.393/anno

- Contabile: $46.076/anno

- Analista finanziario: $78.028/anno

- Agente assicurativo: $72.822/anno

- Consulente per gli investimenti: $70.017/anno

- Servizi fiscali: $73.546/anno

Le stime degli stipendi si basano su dati inviati in forma anonima a Indeed da persone che lavorano in questi ruoli, oltre che su informazioni provenienti da annunci di lavoro passati e presenti sulla piattaforma negli ultimi 36 mesi.

Queste cifre possono variare in base a fattori quali la posizione, le dimensioni dell'azienda e il livello di esperienza.

Se stai pensando di iniziare una carriera nel settore della contabilità o della finanza - o se vuoi crescere all'interno del settore - questo è un momento eccellente per esplorare le opportunità che il settore offre.

![Come scrivere un CV professionale? [+Esempi]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Profile.svg)