Whether your investor resume needs a complete makeover or just a couple of small adjustments, you're in the right place! Comprehensive, yet easy-to-follow — our guide is here to help you pen a compelling resume that sells all your best skills and qualities to potential employers.

Inside, you'll find thorough examples, sleek templates, useful tips, and samples submitted by actual investment professionals. So, let’s make your resume impossible to overlook one step at a time!

Keep on reading to learn all about:

- Exploring valuable investor resume examples

- Choosing a resume format that matches your experience level

- Crafting an attention-grabbing investor resume summary or objective

- Writing a skills section that reflects all your best skills as an investor

- Describing your investor work experience in detail

- Weaving powerful action words into your investor resume

- Properly listing your academic credentials in your investor resume

- Picking the perfect optional sections for your investor resume

- Avoiding common mistakes in an investor resume

- Pairing your resume with a matching investor cover letter

- Average salary and job outlook for investors

- Accessing top resources for job-seeking investors

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

Investment assistant resume sample

Why does this resume example work?

- Comprehensive profile summary: The profile summary is strong and descriptive. It highlights key qualifications such as being a Chartered Financial Analyst and pinpoints essential skills like data analysis and providing investment advice.

- Diverse skill set: The skills section is thorough and covers a wide range of both hard and soft skills. It highlights multilingual abilities and proficiency with industry-specific tools and software, which is crucial in today's globalized financial market.

What could be improved?

- More quantifiable achievements: While the resume mentions a significant cost reduction of 15%, other areas could benefit from additional quantifiable details. For instance, how many clients were managed or assisted? By what percentage did investment recommendations outperform the market? Specific numbers can add more weight to the accomplishments.

- Enhance descriptions with results: Several bullet points in the work experience section could be strengthened by including the outcomes of the actions. For example, "Provided investment advice and recommendations to clients" could be enriched with specifics like the success rate or client satisfaction improvements.

Investment banker resume example

Why does this resume example work?

- Relevant work experience: The work experience section is filled with pertinent roles that align well with the investment banking field. The responsibilities listed are relevant and provide a clear picture of the candidate's skills and accomplishments in their past positions.

- Comprehensive education background: The educational background is robust and impressive, featuring degrees from prestigious institutions like the University of Toronto and the London School of Economics and Political Science. The distinction in bilingual programs adds an extra layer of competency and global perspective.

What could be improved?

- Enhance action words: While the responsibilities and achievements are well-detailed, using stronger action verbs consistently can add more dynamism to the resume. For instance, starting bullet points with "Implemented," "Optimized," or "Spearheaded" can make the entries more engaging.

- Avoid redundancies: Ensure that each entry adds new information rather than repeating similar points. For example, combining similar responsibilities under one bullet point and expanding on unique contributions can make each section concise and focused.

Investment associate resume example

Why does this resume example work?

- Relevant work experience: The responsibilities listed under the work experience section are highly relevant to the investment field. Developing asset allocation strategies, conducting financial modeling, and providing financial advice all align closely with the skills needed for an investment associate role.

What could be improved?

- More specific examples of client impact: While the resume mentions advising clients and providing financial support, more specific examples of client impact would add depth. For instance, detailing the size of portfolios managed or specific strategies implemented that benefited clients could provide a clearer picture of the candidate’s effectiveness.

- Highlight leadership and team contributions: If applicable, mentioning any leadership roles or team contributions within work or academic settings can strengthen the resume. For instance, detailing any mentorship roles or team projects can highlight the ability to collaborate and lead effectively.

1. Choose a resume format that matches your investment experience level

Firstly, it's important to choose a resume format that best reflects your experience level. This step is more than just a stylistic choice — it's a strategic way to highlight your strengths, while drawing the recruiters’ attention away from your weaknesses.

For the sake of clarity, let's discuss the three most commonly used resume formats. Based on your experience level, you can opt for:

- Chronological format: The name “chronological format" is quite self-explanatory. This type of resume puts your work experience section front and central, while organizing your entries in a reverse-chronological order. This format is best suited for those with continuous, long-term work experience in a specialized position.

- Functional format: A functional resume puts emphasis on your skills, education, and certifications rather than your work experience. As such, this format benefits anyone who lacks relevant practical experience, for example, fresh graduates, job-hoppers, career-changers, or those with employment gaps.

- Hybrid format: Finally, a hybrid resume combines both of the two former formats to create a document that evenly spreads its focus amongst all sections. It allows you to give equal weight to your education as well as professional experience.

Regardless of which resume format you go for, remember to stay consistent in its formatting. Use appropriate fonts, professional section headlines, and easy-to-read layout throughout.

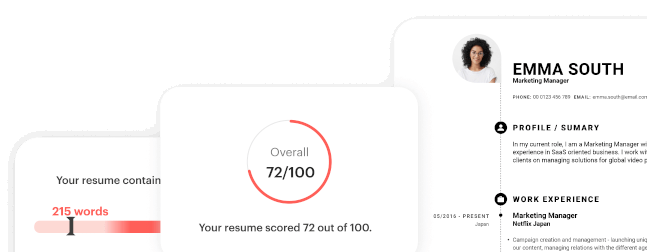

The best way to ensure consistency and professional formatting of your investor resume is to use an expertly crafted resume template.

2. Craft an attention-grabbing investor resume summary or objective

Once you've picked your resume format, it's time to move to your resume summary or resume objective.

Crafting a resume summary

Sitting at the top of the page, right beneath the header with your contact information, a resume summary serves as a teaser inviting the recruiters to read the rest of your resume.

In just 2-4 sentences, you should communicate:

- Your key achievements

- Unique skills

- Qualifications that make you the best fit for the job

Below, you'll find two examples of resume summary, a bad one and a good one, together with a brief explanation:

Bad investor resume summary example

An investor with many years of experience. Worked for several different companies and achieved considerable successes. I have all the best skills and knowledge you're searching for.

What makes this summary so bad? The main culprit here is vagueness. Your resume summary should be short but punchy, containing the very best of your credentials. Remember, the purpose is to make the recruiters pay attention to the rest of your resume, not to be mysterious.

Good investor resume summary example

Highly analytical investor with 7+ years of experience in portfolio management and equity research. Graduated magna cum laude with a M.A. in Finance, further gained a CFA certification. Successfully managed a diversified investment portfolio exceeding $50 million, consistently outperforming the S&P 500 by 15% annually through rigorous quantitative analysis and market trend evaluation.

What makes this resume summary example so good? This example manages to highlight the candidate’s lengthy professional experience, education, as well as certification. Additionally, their major professional accomplishments are bolstered by concrete numbers.

Keep in mind that your resume summary is responsible for making the first impression. Introduce yourself to the recruiters with a bang and show them exactly what sets you apart from other candidates.

Writing a resume objective

A resume objective is similar to a resume summary but is often used by those who are changing careers or just starting out. This section is about stating your career goals and how they align with the company you’re applying to. Here’s how to make it effective.

Why use a resume objective:

- You’re a recent graduate looking to break into the field.

- You’re making a career switch and need to highlight transferable skills.

- You have limited experience and want to showcase your ambitions and enthusiasm.

What your resume objective should include:

- Your career goals

- Relevant skills based on the job description

- How you aim to contribute to the company

Bad investor resume objective example

Looking for an investment position where I can improve my skills and grow with the company.

Why does this objective fall flat? This objective is too generic and doesn’t offer any specifics about the candidate’s skills or how they align with the company’s needs, making it easy to overlook.

Good investor resume objective example

Ambitious finance graduate with a keen interest in portfolio management and investment analysis. Proficient in quantitative analysis and financial modeling. Aiming to leverage strong analytical skills and academic background in Finance to contribute to [Company Name]'s investment strategies and drive superior returns.

Why does this objective work so well? This example provides clear career goals, showcases relevant skills, and demonstrates how the candidate plans to contribute to the company’s success, making it compelling and specific.

All in all, whether you opt for a resume summary or an objective, make sure it’s tailored to the job and showcases the best you have to offer. This opening statement sets the tone for the rest of your resume, so make it count!

3. Write a skills section that reflects all your best skills as an investor

The world of finance and investment calls for a very specific set of skills. And the skills section of your resume is the most sensible place to list them.

But this can't be done at random! As always, you must be strategic about what to choose to include and what to omit. When tailoring your resume to a specific job posting, make sure to include the skills the job posting actually asks for in its job description and requirements parts.

Based on their nature, your skills can be divided into two groups:

- Hard skills: Hard skills are specific and measurable abilities that can be taught through courses or formal education. These may include language proficiencies, financial analysis tools and methodologies.

- Soft skills: On the other hand, soft skills refer to how you carry yourself in the workplace and interact with others.

Here are examples of hard and soft skills relevant for all investors:

Best hard skills for an investor resume

- Financial analysis

- Quantitative analysis

- Risk management strategies

- Market research

- Regulatory knowledge

- Investment software and platforms

- Portfolio management

Best soft skills for an investor resume

- Critical and analytical thinking

- Quick decision making

- Adaptability

- Strong communication

- Attention to detail

- Negotiation

- Networking

PRO TIP: If the company you're applying for uses an Applicant Tracking System (ATS), spell all your skills exactly as they appear in the job posting. This will ensure maximum compliance with the ATS.

To be a well-rounded investor, you need to have a delicate blend of both hard and soft skills. Listing the right skills demonstrates that you have a full understanding of what the position entails. So, take this opportunity to show your potential employers what you bring to the table!

4. Describe your investor work experience in detail

The work experience section is the heart and soul of any chronological resume.This is the part potential employers are most curious to see. It's also your chance to showcase how you used your skills in a real-life professional setting, when faced with specific problems.

A good work experience entry should follow this structure:

- Job title

- The name of the company and the period of employment

- A list of bullet points capturing the most relevant and impressive accomplishments and results.

An example is worth a thousand words, so let's have a look at two model work experience entries and assess their execution:

Bad example of an investor resume work experience section

Investment associate, XYZ Corp.

June 2020-Present

- I used to handle various investment projects in a range of sectors.

What's wrong with this example? Almost everything. It fails to show any particular achievements or results. It’s vague, nondescript, and doesn't show anything that would make employers want you in their organization.

Good example of an investor resume work experience section

Investment associate, XYZ Corp.

June 2020 - Present

- Led the analysis and due diligence of over 100 potential investment opportunities, leading to the successful acquisition of 15 high-growth startups, which collectively enhanced the firm's portfolio value by 35% within 3 years.

- Developed and implemented a comprehensive risk management framework, reducing portfolio volatility by 25%.

- Initiated and nurtured strategic partnerships with venture capital firms and industry experts, resulting in an annual deal flow increase of 20%.

- Led a cross-functional team in the development of a proprietary investment evaluation tool that streamlined the analysis process, cutting down evaluation time by 40%.

Why does this example work? Each bullet point starts with an action verb, saving precious space and making the candidate sound proactive. The bullet points are structured to highlight a specific skill and the results it brought. What's more, using quantifiable achievements wherever possible underlines the value this candidate added to their past employer.

Just like with the skills section, you want your work experience section to align with the needs of your target company as closely as possible. When choosing which achievements to mention in your work description, try to cater to specific requirements outlined in the particular job posting.

What to do if you have little or no experience?

If you're a fresh graduate or have little to no experience in the field, it’s essential to focus on what you do have: relevant coursework, internships, volunteer work, and transferable skills. Here’s how to effectively fill out your work experience section even with limited professional history.

- Highlight relevant coursework and projects: Academic assignments, group projects, and class presentations can all be used to showcase your understanding of the industry. Highlight any projects where you conducted research, data analysis, or any relevant tasks.

- Showcase internships and part-time jobs: Even if these roles aren't directly related to investing, focusing on transferable skills and achievements can bridge the gap.

- Include volunteer work and extracurricular activities: Leadership roles in clubs, volunteer positions, or relevant extracurricular activities can also demonstrate valuable skills and commitment.

Good example of a relevant experience and projects section for a fresh graduate

Finance Student, ABC University

Jan 2018 - May 2022

- Conducted a comprehensive market analysis project identifying key investment opportunities in emerging markets, resulting in a simulated 15% portfolio growth over 12 months.

- Completed an internship at DEF Wealth Advisors, where I assisted in preparing investment reports, conducted preliminary research for client portfolios, and utilized financial software to track investment performance.

- Served as Treasurer of the University Investment Club, managing club funds, organizing educational events, and leading a research team that analyzed stocks and made investment decisions for the club's simulated portfolio, which outperformed the market by 10%.

- Developed analytical models in a financial modeling course to evaluate investment risks and returns, earning top marks in the class.

Whether you’re a seasoned professional or just starting, your work experience section should be tailored to highlight the most relevant skills and achievements that align with the job you’re applying for.

5. Weave powerful action words into your investor resume

Action words in your investor resume are essential for making your achievements and responsibilities stand out. These power verbs can transform your resume from a flat list of duties into a dynamic narrative. But why are they so important?

They inject energy and clarity into your resume, making your responsibilities and achievements stand out. Instead of merely stating what you did, action words emphasize how you did it and the impact you made. This helps hiring managers quickly grasp your contributions and envision you in the role. Simply put, action words turn your experiences into compelling, result-oriented stories.

Here’s a list of potent action words that can help your investor resume pack a punch

- Analyzed: Demonstrates your ability to scrutinize data and make informed decisions.

- Advised: Shows your expertise in providing strategic guidance.

- Managed: Highlights your leadership and ability to oversee projects or portfolios.

- Optimized: Emphasizes your skill in improving processes or returns.

- Projected: Indicates your aptitude for forecasting financial trends and outcomes.

- Executed: Showcases your ability to implement strategies effectively.

- Evaluated: Reflects your critical assessment skills in reviewing investments.

- Negotiated: Demonstrates your proficiency in securing favorable deals.

- Collaborated: Highlights your teamwork and ability to work well with others.

- Outperformed: Shows how you exceeded benchmarks or expectations.

By strategically using action words, you can turn your resume into a vivid portrayal of your professional impact. These verbs help hiring managers quickly see the value you bring, making you a standout candidate in a crowded job market. So, rev up your resume with these action words and watch your career prospects accelerate!

6. Properly list your academic credentials in your investor resume

Your academic background plays a vital role in an investor resume, providing a solid foundation for your qualifications. Employers typically expect their investors to have formal tertiary education, especially in fields directly related to finance. Here’s how to effectively list your education, whether it's finance-related or not.

Finance-related education

If your education is in a field related to finance, such as finance, economics, financial markets, financial modeling, or statistics, you'll want to make this clear and highlight any notable achievements.

What to include?

- Degree name

- Name of the institution

- Years of study

- Honors, awards, or noteworthy projects (if applicable)

Example of a finance-related education section

Master of Science in Financial Markets

University of Economics, Prague, 2015 - 2017

- Graduated with honors

- Presented thesis findings at the Student Finance Conference

Why does it work? This example is concise but informative, clearly showcasing the relevant degree and notable achievements. The mention of graduating with honors and presenting at a conference adds value, demonstrating academic excellence and active engagement in the field.

Non-finance education

If your degree isn’t directly related to finance, focus on listing it clearly and then emphasize relevant coursework, projects, or skills that are transferable to the investment field.

What to include?

- Degree name

- Name of the institution

- Years of study

- Relevant coursework or projects

- Honors, awards, or notable achievements (if applicable)

Example of a non-finance education section

Bachelor of Science in Mechanical Engineering

Technical University of Munich, 2013 - 2017

- Relevant coursework: Financial Engineering, Applied Mathematics

- Completed a capstone project on optimizing investment in energy-efficient technologies

- Graduated with Dean's List honors

Why is this strong? This example highlights the degree while also pointing out relevant coursework and projects that tie back to finance and investment. Including honors further reinforces the candidate’s academic strength.

General tips for listing your education:

- Keep it concise: Your education section should be easy to read and as concise as possible. Avoid lengthy descriptions and stick to the most important details.

- Include notable achievements: If you've received honors, awards, or have notable projects related to finance, make sure to include these. They add depth to your credentials and demonstrate excellence.

- Tailor to the job: If you’re applying for a specific job, tailor your education section to highlight aspects of your academic background that are most relevant to the position.

- Use reverse chronological order: List your most recent degree first, and then move backward. This keeps the most relevant and recent information at the top.

Remember, by properly listing your academic credentials, you provide insight into your formal qualifications, making your investor resume more robust. Even though education may not be the most significant part of your resume, it establishes a strong foundation and demonstrates that you meet the necessary educational standards sought by employers.

7. Pick the perfect optional sections for your investor resume

Besides the expected resume sections, you can also add optional sections. Why include them? Well, in the sea of candidates with very similar resumes, you need to seize every opportunity to stand out. Just remember to tailor them to showcase your strengths, experiences, and qualifications that align with the job position.

Based on your particular needs, you can add sections dedicated to your:

- Certifications: Adding certificates that vouch for your knowledge, skills, or expertise relevant for the job increase your value in the eyes of potential employers. Your investor resume would only benefit from certificates like Financial Risk Manager (FRM) or Chartered Financial Analyst (CFA).

- Volunteering: Including a volunteering section on your resume is a great way to show your alignment with company values, in case your potential employer is also interested in social issues.

- Personal projects: Mentioning projects that you took on outside of your normal employment suggests that you have a genuine passion for investment, as well as your dedication to the craft.

Optional investor resume sections examples

Certifications

- Certified Financial Planner (CFP)

- Chartered Alternative Investment Analyst (CAIA)

Volunteer experience

Volunteer Financial Analyst, Global Health Initiative

March 2020 - August 2020

- Provided pro bono financial analysis and strategic advice to a global health initiative focused on improving healthcare access in developing countries.

- Conducted financial modeling and risk analysis to assess the feasibility of various program initiatives and funding opportunities.

Personal projects

- Financial blog and Investment research platform: Founded and manage a financial blog and investment research platform aimed at providing educational content and analysis for individual investors.

Optional sections like these can offer additional context to your professional life. This makes it the perfect opportunity to inject a bit of personality into your resume.

8. Avoid common mistakes in an investor resume

Crafting an investor resume demands precision and attention to detail. Avoid these common pitfalls to ensure your resume stands out for all the right reasons.

- Vague descriptions: One of the biggest mistakes you can make on your resume is using vague descriptions of your previous roles and responsibilities. Phrases like "Worked on investment projects" or "Handled client portfolios" are too generic and don’t convey the specific impact you had. Instead, be as detailed as possible by including quantifiable achievements and concrete examples. For instance, "Managed a $50 million diversified portfolio, achieving a 15% annual return over three years."

- Overloading with jargon: While it's important to use industry-specific terminology, overloading your resume with jargon can make it confusing and difficult to read. Remember, the person reading your resume might not be an expert in your field. Use clear, simple language wherever possible, and reserve complex terms for sections where they truly add value and clarity.

- Lack of quantifiable achievements: Employers are interested in results, so it’s crucial to include quantifiable achievements that show your effectiveness. Avoid listing tasks you performed without context. Instead, highlight your accomplishments with numbers or percentages. For example, "Increased portfolio value by 20%" or "Reduced portfolio risk by 15% through strategic asset allocation."

- Ignoring soft skills: While technical skills are vital for an investor role, don’t underestimate the importance of soft skills. Interpersonal abilities, communication, and leadership skills are critical in client interactions and team collaborations. Make sure to include examples that highlight these skills, such as "Led a team of 5 analysts" or "Effectively communicated complex financial strategies to clients."

- Poor formatting and readability: A cluttered or poorly formatted resume can be off-putting. Use a clean, professional layout with consistent fonts, headings, and bullet points. Ensure there’s enough white space to make the document easy to read. A well-structured resume not only looks professional but also makes it easier for hiring managers to quickly find the information they need.

- Neglecting tailoring your resume: Sending out the same resume for every job application can significantly reduce your chances of success. Make sure to tailor your resume for each position you apply for by highlighting the most relevant skills and experiences. Refer to the job description and adjust your resume to match the employer's specific needs and requirements.

- Skipping the proofreading: Even a single typo or grammatical error can leave a negative impression. Proofread your resume multiple times, and consider asking a friend or colleague to review it as well. Tools like Grammarly can also be helpful, but a thorough human review is crucial for catching nuances that software might miss.

By avoiding these common mistakes, you can create a polished, professional investor resume that effectively showcases your skills, experience, and achievements. All in all, a well-crafted resume will help you stand out in a competitive job market and bring you one step closer to landing your next role.

9. Pair your investor resume with a matching cover letter

When you’re applying for an investor position, your resume is just one part of your application package. Equally important is your cover letter, which adds a personal touch and provides context to your qualifications. Understanding the role of a cover letter and how it complements your resume can enhance your chances of making a strong impression.

While your resume is a structured overview of your work experience, education, and skills, your cover letter serves a different purpose. It’s your opportunity to speak directly to the hiring manager, explain why you’re interested in the role, and highlight the most relevant parts of your experience. Essentially, the resume lists your qualifications, but the cover letter tells your story.

When to include a cover letter? It’s generally a good idea to include a cover letter with your resume, unless the job posting specifically states not to. A well-written cover letter can set you apart from other candidates by demonstrating your enthusiasm for the position and your understanding of the company’s needs. It also allows you to address any potential concerns, such as gaps in your employment history or a career change.

Ensuring design consistency

One crucial aspect often overlooked is the importance of having a consistent design for both your resume and cover letter. This uniformity not only makes your application visually appealing but also signals to the employer that you are detail-oriented and organized.

Example of matching designs:

- Header: Your name and contact information should be presented identically at the top of both the resume and cover letter.

- Font and size: Use the same font type and size throughout both documents to ensure a harmonious appearance.

- Margins and spacing: Keep margins and line spacing consistent to maintain readability and a clean look.

By including a well-crafted cover letter with your resume, you provide a fuller picture of your qualifications and personality. Ensuring that both documents have a consistent design reinforces your attention to detail and professionalism. This cohesive presentation can help make your application stand out, increasing your chances of landing the investor role you’re aiming for.

10. Average salary and job outlook for investors

When considering a career as an investor, it’s important to understand the financial prospects and job market trends. Let's delve into the latest information to help you gauge your career path in this field.

According to the U.S. Bureau of Labor Statistics, as of May 2023, business and financial occupations, including investors, were making an average yearly salary of $79,050. This gives you a ballpark figure of what you can expect, although your actual salary might be higher or lower depending on where you work, your experience level, and the specific niche you’re in.

The good news? The job outlook for business and financial occupations is great. The BLS projects that employment in these fields will grow faster than the average for all occupations from 2022 to 2032. What’s driving this growth? Increasing globalization, more complex regulations, and a growing need for savvy financial pros who know how to manage investments and portfolios effectively.

What's more, the BLS estimates about 911,400 job openings each year on average over the next decade. These openings come from people moving on to other roles, retiring, or leaving the workforce for various reasons. So, even with the rapid changes and challenges in the financial world, there are plenty of opportunities for new investors to jump in and make a splash.

Understanding both the salary potential and the job outlook can help you make smart decisions about your future as an investor. Whether you’re just starting out or eyeing the next step in your career, the demand for financial expertise means there are plenty of opportunities to make your mark.

11. Top resources for job-seeking investors

You've made it here, which means that now you know how to make an investor resume that can impress even the most demanding recruiters. But do you know which recruiters to impress?

Looking for the right work opportunities isn't always as straightforward as we'd wish it to be. But these resources can serve as an inspiration for your very own job search:

- Industry-specific job boards: Websites with niche focus like Morningstar Careers, eFinancialCareers, or Bloomberg Careers can be great entry points to the world of finance.

- Online job search engines: Next, you can search through platforms with broad focus such as Indeed, Glassdoor, ZipRecruiter, or SimplyHired.

- LinkedIn: Apart from its job search tools, LinkedIn gives you the perfect opportunity to connect with fellow investment professionals and potential employers alike. Networking makes the investment world go round!

- Professional associations: Besides job listings, associations and organizations like the Chartered Financial Analyst Institute (CFA), the Certified International Investment Analyst Association (CIIA), and the Alternative Investment Management Association (AIMA) can offer you access to networking events, further training, and the latest industry news.

- Specialized publications: Keeping up-to-date with the latest industry developments, financial trends, strategies and news can give you the competitive edge you need to succeed. Consider following media such as “The Wall Street Journal,” “Financial Times,” “InvestmentNews,” or “The Economist.”

- Continuous learning: As an investor, you're always a work in progress. To continue sharpening your skills, you may want to take on new challenges. Find the best courses that fit your goals with online learning platforms like Coursera, edX,LinkedIn Learning, or Udemy.

Remember, job offers won’t land in your lap just like that. It's you who has to do all the hard work! So gear up, be proactive, and keep your eyes peeled for suitable opportunities at all times.

And don't forget to keep updating your resume as well as your investor cover letter. After all, if you craft them both with care, these two documents can do some considerable heavy lifting for you. Good luck!

Business Career Outlook in 2025

Employment in Business and Financial occupations is expected to grow faster than the average for all occupations from 2023 to 2033. (Source: U.S. Bureau of Labor Statistics)

Every year, about 963,500 Business job openings are expected to open, primarily due to employment growth and the need to replace workers who leave these occupations permanently.

Average US base salaries across popular Business roles:

- Account Manager: $69,875/year (excl. Commission)

- Business Development Manager: $86,012/year (excl. Profit sharing)

- Business Analyst: $85,143/year (excl. Cash bonus)

- Consultant: $94,841/year

- Investment Associate: $100,004/year

- Procurement Specialist: $68,710/year

- Procurement Coordinator: $99,814/year

- Procurement Engineer: $98,661/year

- Procurement Coordinator: $99,814/year

What key areas/markets attract Venture Capital Investments in 2025?

- Artificial Intelligence (AI): Focus on natural language processing, AI-powered cybersecurity, and healthcare diagnostics.

- Climate Tech and Sustainability: Investments in renewable energy storage, carbon capture, and eco-friendly consumer products.

- Fintech and Decentralized Finance (DeFi): Interest in blockchain lending platforms, digital wallets, and financial automation tools.

- Healthtech and Biotech: Growth in personalized medicine, digital health platforms, and mental health technology.

(Sources: The Successful Founder & Forbes)

Investor Resume FAQ

Any tips on how to show off my skills in an investor resume?

Show, don’t tell! Instead of simply writing the phrase "analytical thinker" into your skills section, try to include an example of a real-life situation in the job description of your work experience section. Make sure to mention what skills and knowledge you utilized, and what result you achieved. For example: “Conducted quantitative analysis of investment opportunities, utilizing advanced financial modeling techniques to assess risk and return metrics, resulting in a 15% improvement in portfolio performance."

What common mistakes should I avoid?

By far the worst mistake you can make is NOT customizing your resume to fit the description of the job posting you're applying for. Other common mistakes include: misspellings, grammar mistakes, typos, generic phrases, and filler words. But all of these details can be smoothed out by careful proofreading.

I'm submitting my job application via ATS. What's the best way to use keywords in my investor resume?

Remember that effective keyword use isn't about overstuffing your resume with the most words from the job description. Instead, sprinkle these naturally throughout your resume when writing about your skills, experience and qualifications descriptions. And make sure to spell them exactly as they appear in the job posting!

How much work history should I include in my investor resume?

Generally, focus on the last 10-15 years of your career. Older positions can be summarized under a header like "Prior Professional Experience." But remember, content relevance matters more than chronological order. Your headline-making deal from 16 years ago? It definitely deserves a spotlight! But the usual practice is to go into greater detail on your last 2-3 positions.

How should I handle 'gaps' in my work history on my resume?

In such cases, honesty is the best policy! But context also matters. So, rather than just leaving a blank space, address the gap and put a positive spin on it. Did you take time off for personal development, volunteer work, or learning a new investment strategy? Show how you spend the time off in a productive way. You can also address this in your cover letter.

![How to Write a Professional Resume Summary? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Profile.svg)

![How to Put Your Education on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Collage-Universities.svg)

![How to Describe Your Work Experience on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/Experience.svg)